So I keep saying few things about entry like below.

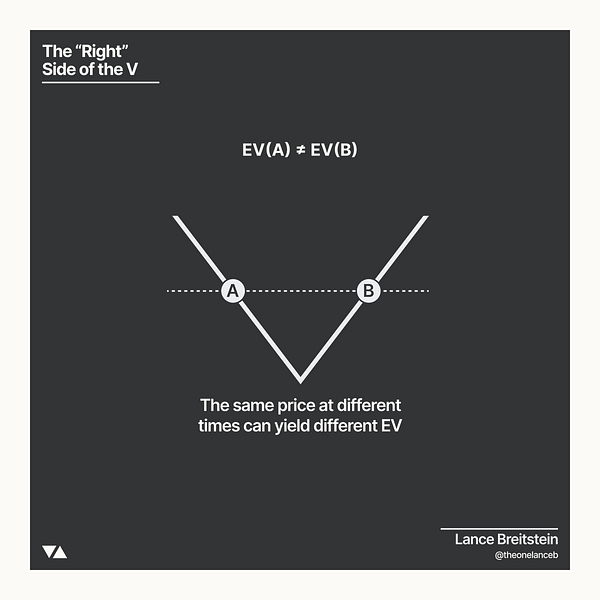

When shorting always short on right side of the “A (or inverse V)” and when longing long against right side of the “V” with setup price in mind. Remember Entry(A) =/= Entry(B) as in tweet/diagram below by Lance. Always enter at B. At least you know that if it goes back below bottom of V or top of “A” then you may need to get out. Also while entering make sure you entering as price is moving in direction of trade.

Just watch price and if needed watch for one minute(or 30 or 10 seconds if you are able to manage) bar to close below for short or above for long and enter based on setup price and keep stop that works for you

You don't long when its going down on 1 minute chart. Wait for it to make that low and let it come back up. Long when its moving up on 1 minute or lower time frame chart and reverse applies for short. Don’t short when its going up on 1 minute/10second chart.

Every one here should focus on setup price I give and use 1 minute/10second bar chart to take position. You could pretty much use stop below 1 minute bar chart's previous low on long and vice a versa.

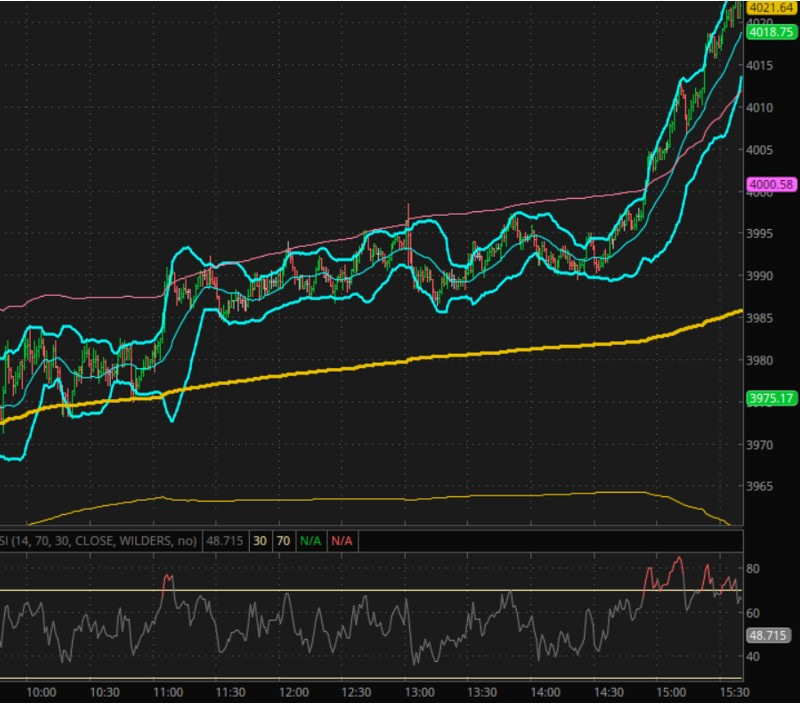

Check second diagram below for visual of my entries on Dec 12,2022.

Basically as you can see my entry points and tweet are shown on 1 minute bar chart. I am buying only once it starts going up as trend is your friend. Never fight trend. I will do same on short and will short when it starts going down. So let it short term bottom on 1 minute chart before you enter on long or top it for short, basically long on the right side of short term "V" bottom on 1 minute as pointed in chart below at various entry points and short on the right side of the “A". Some time you have already have “V” present on short term and you are using it. Some time new V is forming and you might have to anticipatorily take shot but with risk in mind that V might be invalidated. This concept is explained by

on twitter on pinned tweet very well.

An alert was posted on telegram/twitter at 10:23 AM on Dec 12,2022..

As marked as point 1 on below 1 minute bar chart. I went long at 10:24 at 78. Got stopped out at even on move down. I did enter again little higher at 78.25 (Not shown on chart here) It went up to 82 and stopped me out on move down to 76.

I went long again at point 2 at 77 and that went all the way up to 4026. Though I took out most before it.

Same story. I put long at 11:11 against 84/86. These ones are tricky as they may not pull back all the way. you just wait for it to stop as it stopped at 86 and then go long at 87ish. I did not go long here as I was already in long from point 2 above.

It came back again and stopped out long 87 for those who entered. Stopped at 84 and gave opportunity to go long at 85ish. I did this long as I was out from previous long runner. This ran all the way up to 4026 but I was out at 4012.

Here is what this day ended up looking like.

Another example of short against 36 and long against 40 on 12/20 on 10 second time frame chart. Its easier to see V or A (inverse V) on 10 second chart compared to 1 minute on 12/20/23

Short against 54/56 on 12/20/23

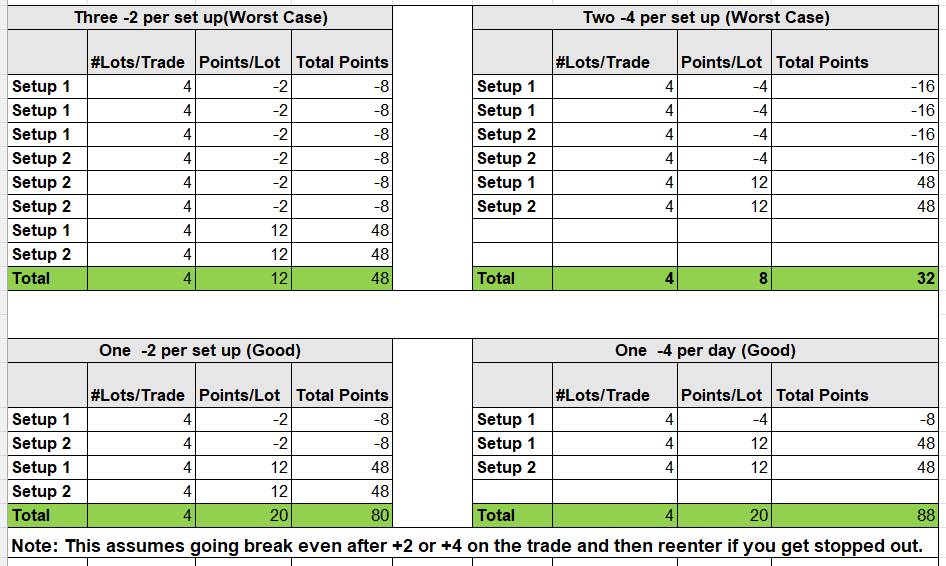

Stops Strategies:

So I use -2 stop on entry during non volatile market and go to break even on +2

during FOMC, CPI events I do use -4 stop on entry and go to break even on +3 or +4

Many traders who follow my setups are using -3.5 as stop and go to break even on +2.5 or even after they get paid on first two.

During choppy market if I have to reenter multiple times I still keep -2 stop but I go to break even on +1 just so that not to get hurt with -2.

Some may want to keep stop at low/high(for long and short respectively) on 1 minute chart.

Some folks like to keep their stop in place until they get paid on first two lots to avoid reentries. Its all up to you as what works for you.

Some folks use time stop. If trade does not work within first 4-5 minutes of entering the trade they scratch it.

Every one has to come up with what works for them and try to perfect and stick with it.

Reentries:

Most setups will give double or triple dip chances. You will get in, get +8 or even +12 on 3rd and it will come back and stop you out. You reenter and you get again +8 and so on. So be ready for that. A setup is always valid until its canceled. Risk is limited to -2.

Other risk management strategies:

Once I am plus 2 on trade I go break even. Some time when I see market is choppy, I go break even faster at +1 on trade to avoid -2’s. Again this is what works for me. You may just avoid just such chops. Not all setups are for every one. Not participating is a trade. Just because you are paying for sub and I am posting that does not mean you need to trade. You can just stay away completely some time of day (like afternoon chop or 8 pm to 2 am during globex) or some of the days (Fridays or Mondays). Market will be there.

If you develop a process with -2 or -4 stop, you can make $. Its not about being right but extracting good points when you are right scale out strategy. If you take first 2 out at +8 then 3rd at +12 & put trailing stop on 4th at +16 you are averaging +12 on trade that works.