Recap & Playbook for week of Feb 19th

Short week, do we break out of consolidation from Feb beginning or continue?

Traders, hope you all had a wonderful long weekend.

Recap Last week:

Last week ES futures closed down only 20 points down from its open. It traded up 4186 and down 4056, a pretty good 130 point range for trading.

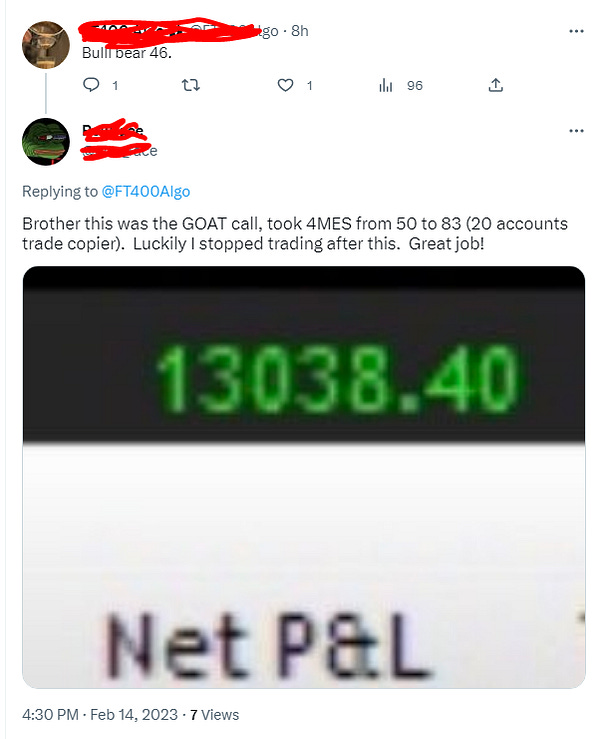

I have been posting summary of our trading almost every day on sub stack and twitter so won’t repeat those. We have been able to get easily 300+ pts this week with tradable bull bear, edges for night session and then levels that has been working magical.

Playbook for next week:

As a trend trader I have setups that are only looking for next 20 points on ES as a day trader. Of course some time that opportunity may turn into 50 to 100 points and we always have runner that takes advantage of that but we do not hope that market will move 100 pts every day and that’s simply unrealistic. We do not swing trade. Every trade is closed on same day with only runner left for over night session.

We are at the bottom of the consolidation flag/area since Feb beginning. Let’s see if it breaks down or stays in the zone. This week main levels I am watching is 4091, 4076 & 4052. Rest of the levels, live setups and other educational content as it happens are posted on private telegram/twitter.

If you subscribe to telegram/twitter then it includes daily levels and thoughts as they are also posted on private telegram/twitter.

New subscription option: As many people are interested in only levels and thoughts every day, I have created sub stack monthly & yearly option just for that now, these options does not include intraday trading on ES futures that I post on twitter/telegram. I may start posting some longer term ideas on it but for now its just levels and some short/long ideas. If you subscribe on sub stack as founding member then it also includes private telegram/twitter.

Econ This week:

Tuesday: PMI & Home Sales

Wed: Last FOMC Minutes

Thurs: Jobless Claims & GDP

Friday: PCE & New home sales & Mich Consumer