Recap & Playbook for week of Jan 29th

TSLA at important resistance. FOMC rate hike. AAPL AMZN & GOOG Earnings

Traders, hope you all had a wonderful weekend.

Recap Last week:

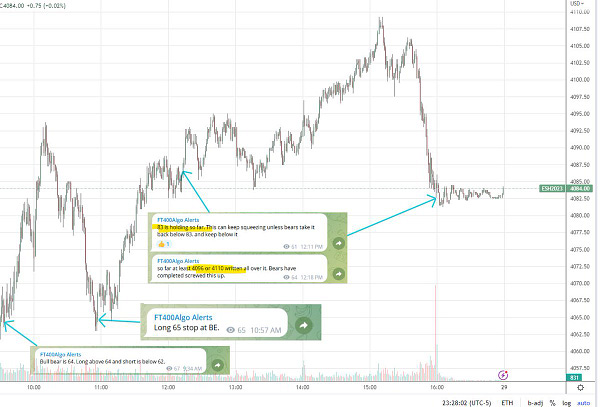

Last week ES futures closed up about 100 points from its open. It traded up 4109 and down 3963, a pretty good range for trading. I had 4K was line in sand as bull bear line and once bears gave away 4K, 4100 was inevitable. Pretty good week with multiple great setups that kept us on right side of the trend. I have been posting summary of our trading almost every day on public twitter. Some of it copied here.

Playbook for next week:

As usual, I have setups that are only looking for next 20 points on ES as a day trader. Of course some time that opportunity may turn into 50 to 100 points and we always have runner that takes advantage of that but we do not hope that market will move 100 pts every day and that’s simply unrealistic. We do not swing trade. Every trade is closed on same day with only runner left for Globex (Over night session )

This week main level I am watching is 4083 as a bull bear line. Of course 4110 is going to be important as well as that was the level we had on Friday. Will be watching TSLA price action as well as it hits major resistance at 180. Lot of earnings this week with some of the big tech APPL, GOOG, AMZN and of course Feb 3rd is going to be FOMC rate hike. I suggest to trade only reaction to rate hike. Rest of the levels, live setups and other educational content as it happens are posted on private telegram/twitter. Upgrade to see action.

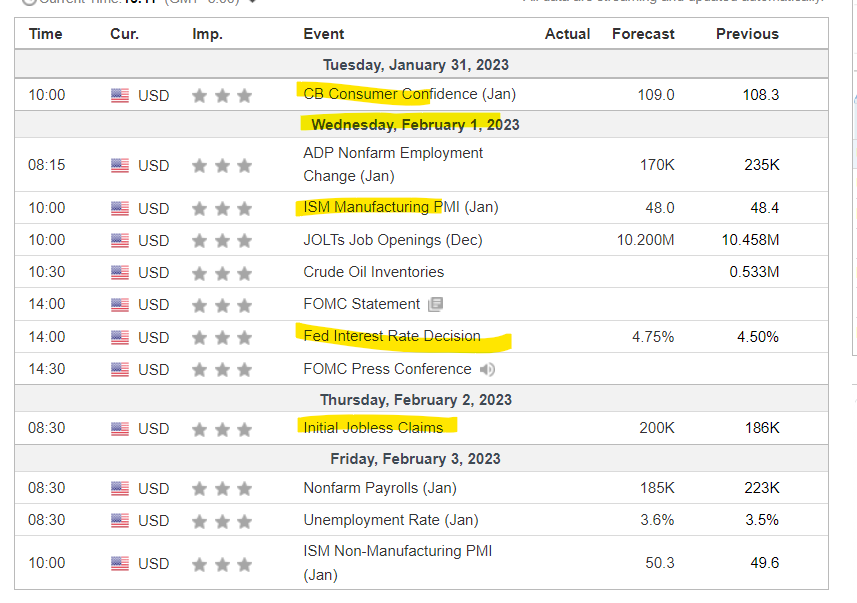

Important econ for this week to watch besides FOMC rate hike.