Recap & Playbook for week of Jan 22nd

Break out, fake out or just chop? Debt ceiling crisis continues.

Traders, hope you all had great week end.

Recap Last week:

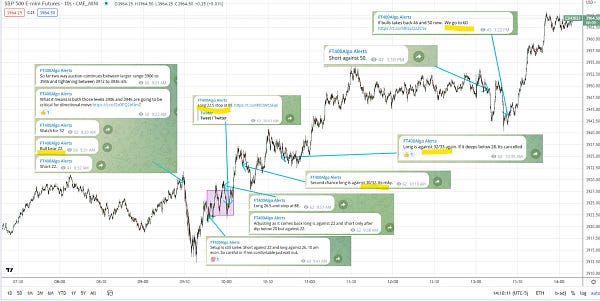

Last week ES futures closed down 30 points from its open. It traded up 4035 and down 3903, a pretty good range for trading. Pretty good week with some chops where we stayed out mostly by defining chop areas. Behind the paywall we took advantage of Short from 4022 on Jan 18th and again re shorted at 4012 and 3071 and held runner thru globex until it bounced from our level at 3906.

Room also took advantage of upside move on Friday.

Playbook for next week:

As usual, I have setups that are only looking for next 20 points on ES as a day trader. Of course some time that opportunity may turn into 50 to 100 points and we always have runner that takes advantage of that but we do not hope that market will move 100 pts every day and that’s simply unrealistic. We do not swing trade. Every trade is closed on same day with only runner left for Globex (Over night session )

We do not care if Fed will pivot or not, whether inflation has peaked or not, of course that’s something you should look into for your longer term portfolio but not for day trading. For day trading just look at whether you can extract next 20 to 40 points from ES futures or not. On shorter time frame remain bearish below 4K and on longer time frame remain bearish below 4200.

Important level going into next week are going to be 3906, 3946, 3985,4k. Rest of the levels, live setups and other educational content as it happens are posted on private telegram/twitter. Upgrade to see action.

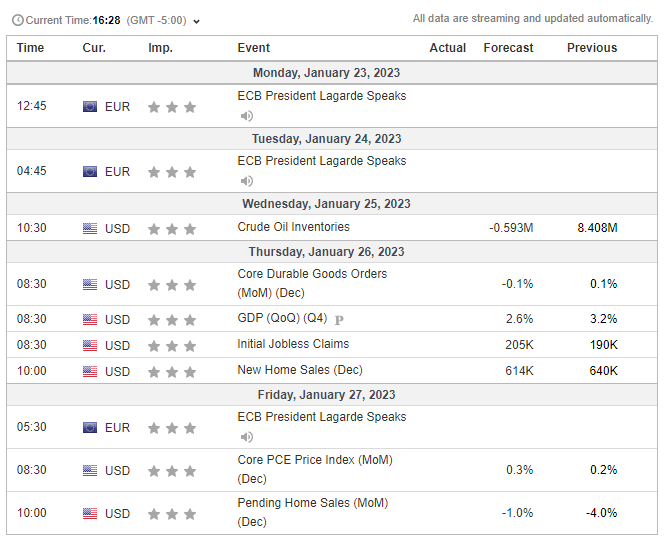

Important econ for this week to watch besides debt ceiling crisis.