Hello traders, Hope you are having relaxing long weekend. Happy Memorial day and be grateful to those who served. Monday is short trading hours with futures closing at 1 pm ET so if you are trading funded accounts be sure to close your positions.

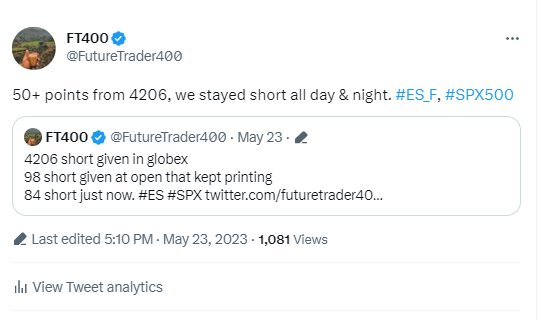

We continue to stay in balance on weekly basis. Last week /ES futures closed up merely 30 points up from its open at 4189, but it has traded 100+ point range from 4114 to 4223. FT400 nightly setups for sub stack subscribers and live telegram setups provided 300+ points this past week. Visuals of some twitter post throughout the week.

Playbook for next week:

As a day trader I have setups that are only looking for next 20 points on ES . Of course some time that opportunity may turn into 50 to 100 points and we always have runner that takes advantage of that but we do not hope that market will move 100 pts every day and that’s simply unrealistic. We do not swing trade. Every trade is closed on same day with only runner left for over night session.

We are back at upper edge of 400 point chop box that market has been in since October. So unless we keep holding 4220, this has very high chance to stay in the range. This week main levels I am watching are 4312, 4260🔥,4220, 4206, 4196, 4186🔥,4172, 4154. I will also be keeping eye as we may start trajectory back to lower edges of the chop box. Rest of the levels, live setups and other educational content as it happens are posted on private telegram

Bull bear line on weekly basis is going to be 4186.

If you subscribe to telegram then it includes daily levels and thoughts as they are also posted on private telegram.

Offline subscription option: As many people are interested in only levels and thoughts every day, I have created sub stack monthly & yearly option just for that now, these options does not include intraday trading on ES futures that I post on telegram. I may start posting some longer term ideas on it but for now its just levels and some short/long ideas. If you subscribe on sub stack as founding member then it also includes private telegram.

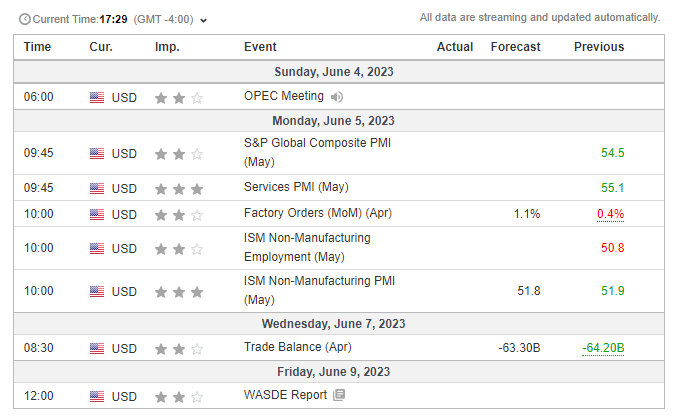

Econ for the week: