Hello traders, This is free newsletter sent out every week. To join my telegram subscribe thru my substack. Big prop firm promotions. Apex has 90% off evals Use FT400 code. $50resets and Fundingticks (New firm) 35% OFF all Accounts Evals (Pro+) starting at $64 Straight to funded (Zero) starting at $216 Use Code: F400 (its not FT400 as their naming does not allow me that code). Now back to business.

Last week ES futures show largest drop with almost 200 handles decline after consecutive weeks of upside. As I write this we are up about 20 handles up from last week’s close.

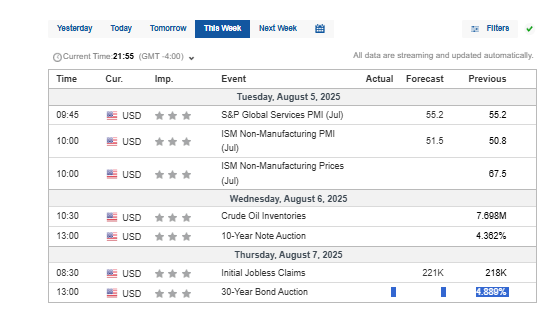

For the week of August 4–8, 2025, key economic events likely to impact U.S. stocks include:

U.S. Factory Orders (Aug 4): Signals manufacturing health; strong data could lift industrials (e.g., Boeing), while weak numbers may pressure broader indices.

U.S. ISM Services PMI (Aug 5): Reflects services sector strength; a high reading boosts consumer stocks (e.g., Disney), a low one raises slowdown fears.

U.S. Trade Balance (Aug 5): Tariff-driven deficit changes could hit retail/tech stocks (e.g., Walmart) amid new 18% tariffs.

U.S. Initial Jobless Claims (Aug 7): Rising claims may signal labor weakness, hurting cyclicals (e.g., banks); stable claims support market confidence.

Corporate Earnings (Aug 4–7): Reports from tech (AMD, Palantir), consumer (Disney, Yum!), and others will drive sector volatility; strong results could sustain S&P 500’s 20% YOY rally, weak ones may spark sell-offs.

Tariff Uncertainty: Ongoing trade policy noise could weigh on consumer and import-heavy stocks.

Fed Sentiment: Post-July’s weak jobs data (4.2% unemployment), hints of a September rate cut could lift growth stocks (tech), while caution favors defensives (healthcare).

Trade reveiws from X posts from last week as usual we played both sides.

July 30: Noted 6400 as a key level holding, awaiting a breakout. No regular trading hours (RTH) trades were taken, with focus on monitoring for significant moves.

July 31: Reported a long trade at 6432 for 20 handles, followed by shorts at 6442 and 6424. Bears were advised to keep prices below 20 to target 92 or lower. A Mexico tariff pause triggered a 20-handle gain, shifting to a long bias above 20, targeting 42 and 56. A short trade from 6420 yielded 30 handles, with bears needing to hold below 96 to push toward 6360. Liquidated near 62, with a Globex short below 6388/92 and long above 60.

August 1: Shorted Globex versus 6360, down 100 handles. RTH short from 6306 to 6266, with bears aiming for 6200 if 6250 and 6236 broke. Later, 6250 held, with a shallow dip to 36 and a bounce to near 6300. Bears needed to keep below 80/84 and break 60 to maintain control, while bulls could push to 6336 if 60 held.

Prop Firms Promotions

I will list best promotions on good prop firms going forward. They are best way to learn and make money without blowing up 100’s of thousands of your own dollars.

Apex has 80% off evals Use FT400 code. $50resets.

Fundingticks (New firm) 35% OFF All Accounts Evals (Pro+) starting at $64 Straight to funded (Zero) starting at $216 Use Code: F400 (its not FT400 as their naming does not allow me that code)

TakeProfitTrader 40% Off & no activation fees. Use FT400 code.

TicktickTrader has 70% off Straight to funded accounts, 30% evals. Use FT400 code

Econ Calendar:

Night session Trading Suggestions:

I suggest to not trade night session from 10 pm to 2 am chop. If action has to happen than it will happen before 10 pm or after 2 am EST. You can generally play short on top level provided for nightly range and long on lower level of nightly range after 2 am or 3 am. But get out of the way if it rips or drops thru levels and wait for new opportunity or flip. And of course never add to loser and better yet cut it and reset.

Remember: I never short above or long below my marker. I wait for it to pause before it or come back to it from rip/dip and pause before executing.

Never take position before Econ like CPI Or FOMC. After econ watch for levels where it stops and how it interacts to decide long or short.

Recommended stop: -2 and go to BE on +2. Some ppl who can't reenter shall chose -3.5/4.

Scale out: 2 lots at +6/8, 3rd at +10/16, 4th leave runner at BE

Big picture: > 5700 this remains bullish.

Rest of the content is for paid sub stack users and is also shared with members on private telegram channel (Note to telegram members: please do not ask me that you do not have sub stack access, you don’t but the content behind paywall is already posted on your channel. Thank you).

Sub stack subscription does not include real time telegram alerts it only includes this nightly news letter with levels and possible setups. For real time alerts please go to https://futuretrader400.substack.com/about

Levels, & Possible Targets: 🔥🔥= Critical (These are now for September U Contract)

Long term view: As far as > 5700 tape remains in bulls’ control

Bull bear: 6284(Weekly bull bear level is 6360)

Above: 6302, 6320🔥, 6336, 6360🔥🔥, 6376 6400🔥

Below: 6280/84🔥, 6260, 6236🔥, 6224, 6200, 6180, 6166🔥🔥

Trade ideas: Short < 6284 flip on conversion. Long vs 6260 upto 6250 until that converts. Targets above are 6360 and below are 6166 on continuations.

Note: Use my globex Pivot/opening setup as main directional guide and then other setups as guidance. Flip or go flat if setup reverses as I may not be in front of my screen all day, you should by now know how the process works at most you have 2/4 handle risk. Setup generally reverses on 1 minute close above/below 3/4 handles from marker. Again there is no sure shot as some time I might relax that or may go predictive. That’s general rule anyway. Also most of the time setups always gives opportunities to reenter some time even multiple times so never take trade too far away from setup markers